How To Sbi Loan Moratorium

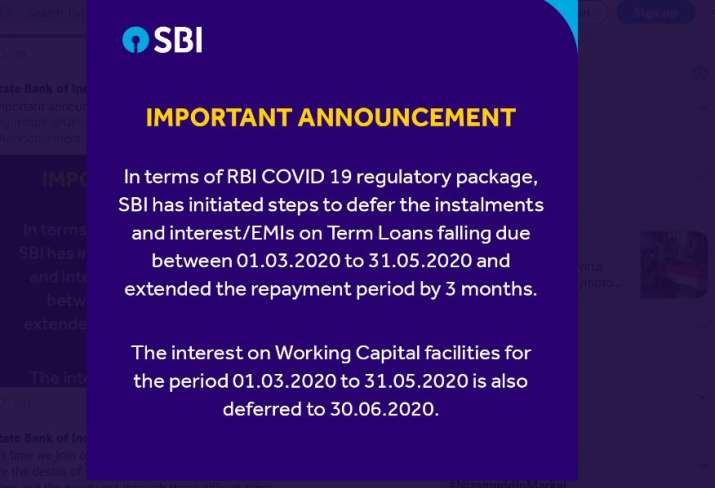

So the total repayment period of the loan will be extended by 3 months over the original repayment period. This makes it a six-month moratorium on term loan EMIs starting from March 1 2020 to August.

Apply For Sbi Loan Moratorium Step By Step Youtube

The State Bank of India is offering a loan moratorium for six months that began from March 1 2020 and is up to August 31 2020.

How to sbi loan moratorium. The bank is also proactively reaching out to all of its eligible loan customers to obtain their consent to stop their Standing Instructions SI NACH mandate for the EMIs falling due from 01062020 to. The Reserve Bank of India RBI extended the moratorium on loan EMIs by three months ie till August 31 2020. Receive a non-binding offer and sign with BankId.

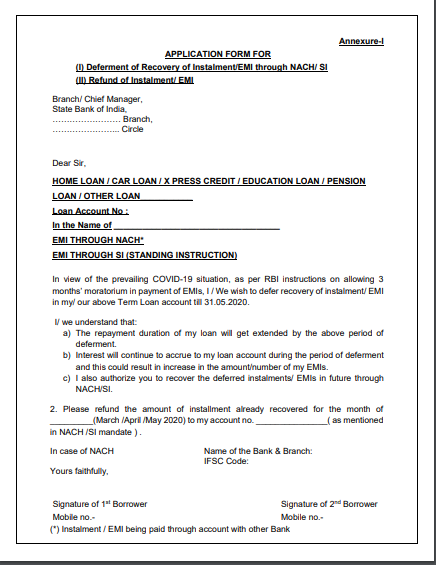

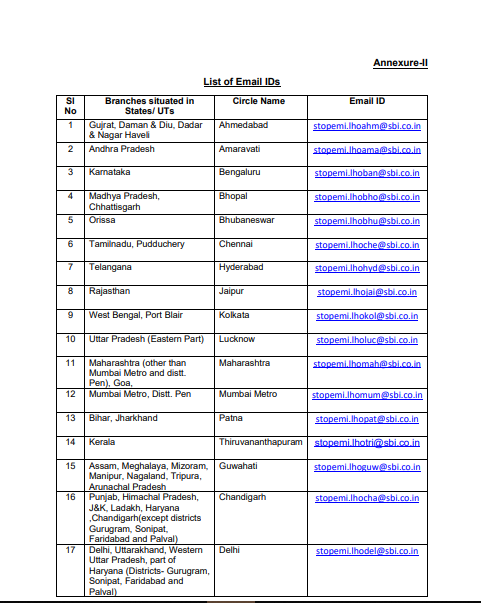

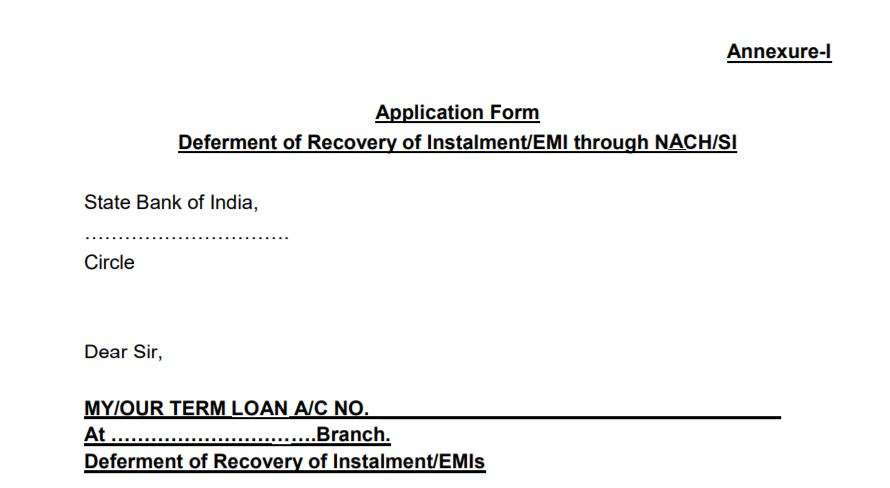

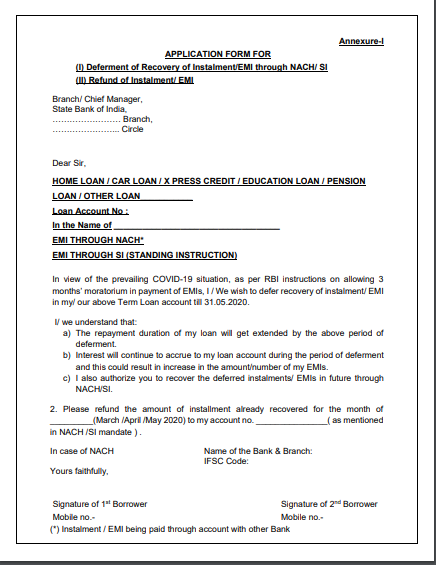

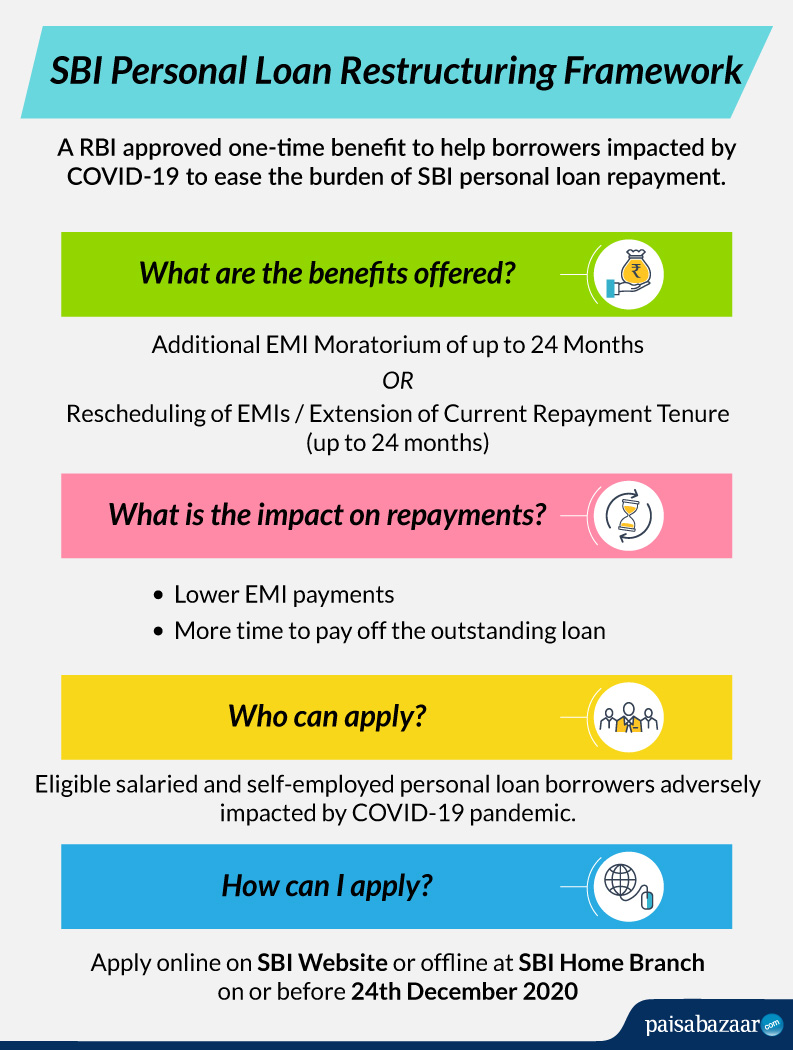

Receive a non-binding with low interest. To apply for the SBI Personal Loan EMI Moratorium a customer can follow any one of the following methods. Some key aspects relating to SBI Personal Loan Moratorium including the eligibility criteria application process etc.

SBI loan moratorium for upto 2 years All you need to know According to the Frequently Asked Questions FAQs put out by the bank on its website a retail borrower who avails restructuring or. Call the customer care numbers of SBI and inform the executive about your requirement. The Reserve Bank of India announced a three-month debt moratorium due to the Coronavirus pandemic.

As per this directive SBI has offered its personal loan account holders a moratorium of up to 6 months on EMI payments due between 1st March 2020 to 31st August 2020. The earlier three-month moratorium was ending on May 31. Here is a look at the details of SBIs loan EMI moratorium according to its website.

Indias largest lender State Bank of India is likely to offer a three-month moratorium to all its term loan borrowers as a way to ensure the quick pass-through of relief measures announced by the Reserve Bank of India. The Reserve Bank of India RBI has asked all lending institutions including banks and housing finance companies HFC will have to give their borrowers a three-month moratorium on term loans. SBI loan moratorium is a postponement of the EMIs that a borrower is bound to pay every month.

The minimum amount for the loan has been fixed at Rs 25000 by the bank and the interest will be 85 percent per annum. What is SBI Personal Loan Moratorium. The moratorium was for payment of all instalments falling due between March 1 2020 and May 31 2020.

Share for everyone to use. In addition to this the borrower will also be given three months of loan moratorium. The loan moratorium can be availed across loan products like home loans and auto loans amongst others.

While applying for the loan the borrowers will not be required to pledge any asset as security as these loans are collateral-free. Mainos Loan without security. SBI will offer the moratorium to all customers rather than making individual assessments two senior officials told BloombergQuint.

In this video we have mentioned How to apply SBI loan EMI and Credit card payment moratorium online 2020. According to the RBI deferred instalments under the. Mainos Loan without security.

Borrowers will also have the option to reschedule their installments by extending a tenure by a period equal to the moratorium period. The borrower needs to enter valid details like account numbers and. Watch the video as much as possible.

How to apply for SBI Personal Loan EMI Moratorium. State Bank of India SBI EMI Moratorium For all the term loan repayments which have been extended till 1 March 2020 by the State Bank of India SBI it will offer a complete moratorium and the final call in regard to the same can be taken by the borrowers. Receive a non-binding offer and sign with BankId.

The Bank advises people who have sound cash flows not. The moratorium is for payment of all instalments and interest on loans falling due between March 1 2020 and May 31 2020. While customers can defer their EMIs and loan repayments.

With the SBI Loan Restructuring Scheme the moratorium period for all types of Retail Loans can be extended by a maximum of 2 years. Accordingly the total moratorium period in all eligible term loan account will be extended by 6 months. Receive a non-binding with low interest.

The call should be made from the registered mobile number. The customer can visit SBI official website to apply for loan restructuring option.

How To Avail 3 Months Loan Emi Moratorium From Sbi

Sbi Personal Loan Covid 19 Moratorium Emi Period How To Apply Status

Sbi Alert Sbi Bank Announces 3 Month Emi Moratorium Check How It Impacts Your Loan And Its Total Payout Business News India Tv

Sbi Emi Moratorium How To Avail Three Month Moratorium For Sbi Emi And Credit Cards

Sbi Extends Loan Moratorium For 2 Years On Home Retail Loans Finance Buddha Blog Enlighten Your Finances

Sbi Loan Emi Moratorium 2 0 Apply Online Defer Sbi Loan Emi Till 31aug Youtube

Sbi Emi Moratorium How To Apply Live Demo Apply For Sbi Loan Moratorium Sbi Emi Moratorium Youtube

Sbi Bank Loan Emi Moratorium Online Apply Full Details Loan Emi Moratorium Online Form Apply Sbi Youtube

Sbi Personal Loan Covid 19 Moratorium Emi Period How To Apply Status

Taken Loan From Sbi Interest Will Mount If You Don T Pay Emis For 3 Months Businesstoday

Sbi Personal Loan Restructuring Covid19 Paisabazaar Com

Posting Komentar untuk "How To Sbi Loan Moratorium"