How To Opt Icici Personal Loan Moratorium

HDFC Bank is extending this facility to everyone including those customers who did not opt for the moratorium. Updated FD Interest Rates 2021 A fixed deposit or FD is a type of investmentsavings account in which the banks or the NBFCs provides the investor with a higher rate of interest than a regular savings account.

ICICI Bank is committed towards making electronic payment acceptance fast easy and secure for merchants of all sizes and business sectors.

How to opt icici personal loan moratorium. Canara Bank Personal Loan. Opting for personal loan moratorium in the times of COVID-19 crisis can release some financial stress. Other conditions remain the same as restructuring 10 and banks can modify the loan terms to offer a moratorium for the outstanding up to a maximum of 2 years.

It is a restructuring of the terms of the loan. If you have had opted for the same and now have too much bill piled up you can opt for loan on credit card or personal loan as per your convenience and try to pay off the debt as quickly as possible. However once the loan restructure application is approved the card account will be reported to.

The page contains ICICI Merchant Services IMS IMS Payment Solutions MPOS IMS Value Added Services IMS Reach. What is meant by moratorium on term loan. The best feature of education loans is that one can enjoy a moratorium period during which a borrower does not have to pay anything.

How to apply for a Personal Loan at ICICI. This kind of a loan should always learn about the maximum loan tenure offered by the lender before he or she decides to opt for this scheme. The plan provides insurance coverage until the age of 75 years.

The final conditions will be evaluated on a case-by-case basis and will be decided by the lender. HDFC Personal Loan EMI Calculator FAQs. The moratorium period provided in this plan is three and seven years.

ICICI Pru Group Insurance Scheme for Pradhan Mantri Jeevan Jyoti Bima Yojana. Will it affect my EMI. The moratorium period on credit card payments by RBI ended on 31st August 2020.

The investor may or may not need to open a separate account and the maturity amount gets deposited in the banks savings account after the maturity date. Loan on Credit Card Vs Personal Loan. With Single Pay Option the minimum sum assured can start with Rs5 000.

The administration process to add new members is simple and easy. The tenure on the restructured loan can be up to 2 years. ICICI Personal Loan Interest Rates.

When should I opt for a personal loan. However it can weigh heavily on you in the near future. I want to opt for HDFC personal loan moratorium.

Moratorium is a sort of granting of a holiday- it is a repayment holiday where the borrower is granted an option to not pay during the moratorium period.

How To Opt Icici Bank Moratorium June July August Youtube

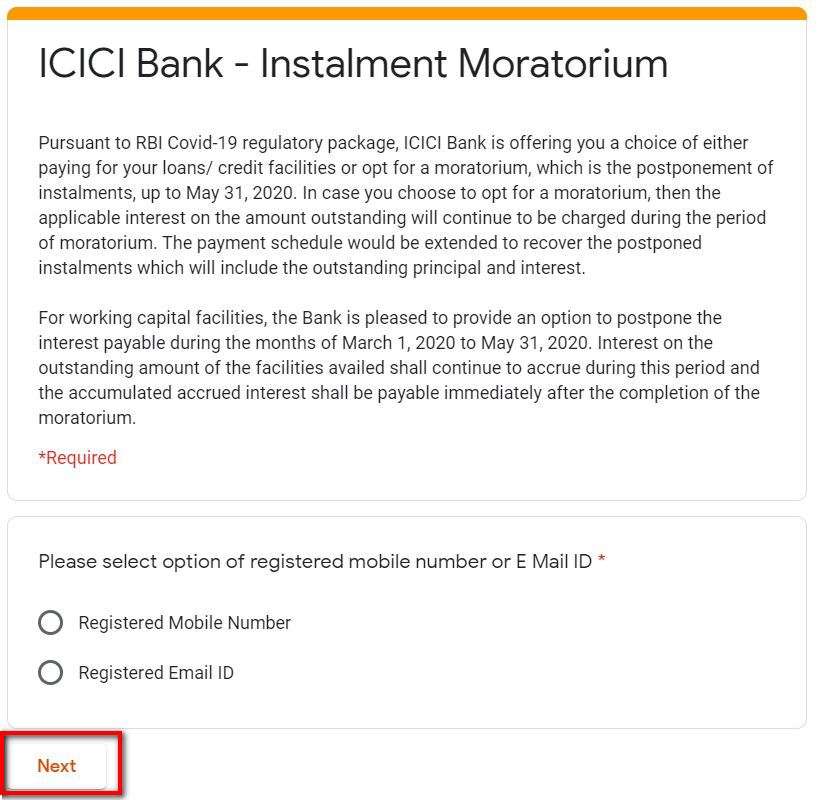

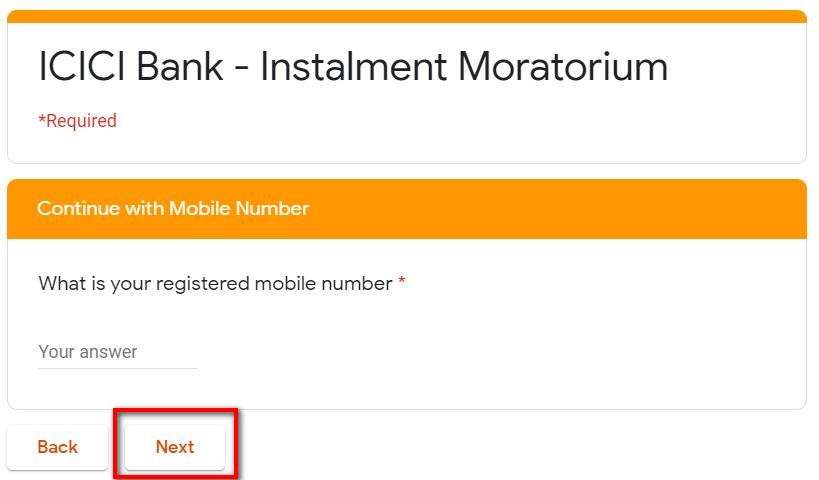

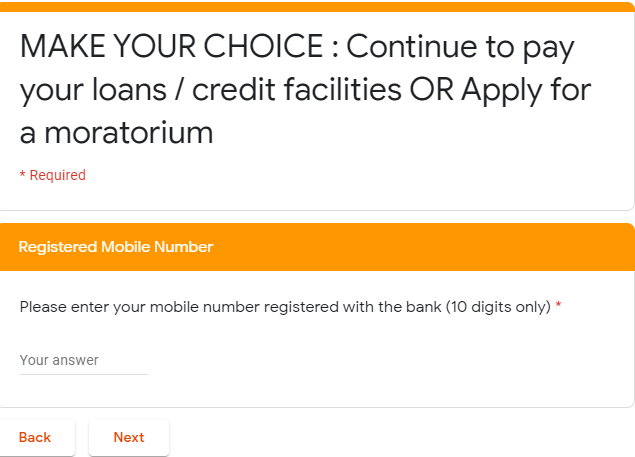

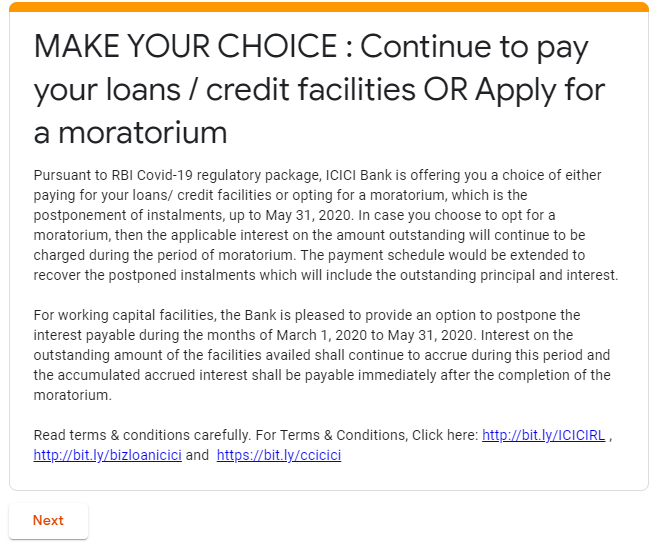

Apply Icici Bank Emi Moratorium Online Terms Charges

Icici Bank Moratorium Apply Credit Card Loan Emi Moratorium Extention And Status

How To Avail Three Month Moratorium For Icici Bank Emi And Credit Cards Business Insider India

Icici Bank Loan Emi Moratorium Terms Conditions And Charges

How To Avail Three Month Moratorium For Icici Bank Emi And Credit Cards Business Insider India

Icici Bank Loan Emi Moratorium How It Works And The Charges The Economic Times

Icici Bank Moratorium Apply Credit Card Loan Emi Moratorium Extention And Status

Icici Bank Moratorium Apply Credit Card Loan Emi Moratorium Extention And Status

Icici Bank Personal Loan Covid 19 Moratorium Emi Period How To Apply Status

Icici Bank Personal Loan Covid 19 Moratorium Emi Period How To Apply Status

Posting Komentar untuk "How To Opt Icici Personal Loan Moratorium"