How To Update Moratorium In Icici Bank

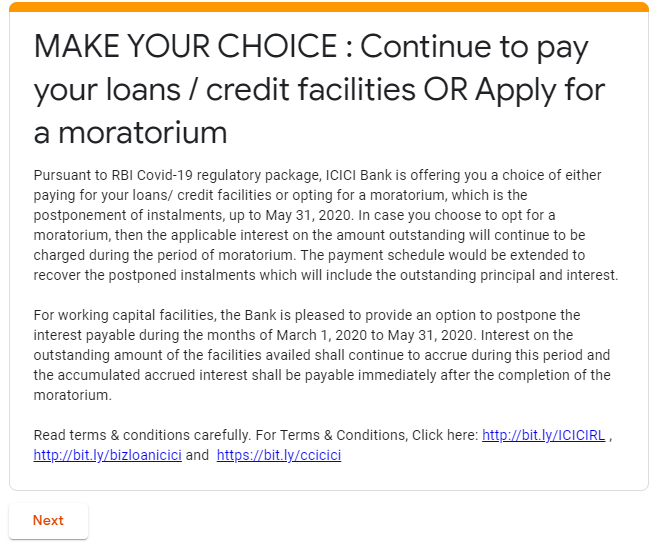

ICICI Bank customers may apply for moratorium cancellation on or before the 24th day of the moratorium month. You can opt for the moratorium by simply clicking on the link shared with you by the Bank through SMS or e-mail.

Icici Bank Moratorium Apply Credit Card Loan Emi Moratorium Extention And Status

However in such cases banks generally insist that the borrower pay the interest during the moratorium period also called pre-EMI interest.

How to update moratorium in icici bank. ICICI Bank COVID-19 Regulatory EMI Moratorium. ICICI Bank has sent an emailSMS regarding the moratorium to all eligible borrowers. After a period of three years the full EMI is paid by the borrower.

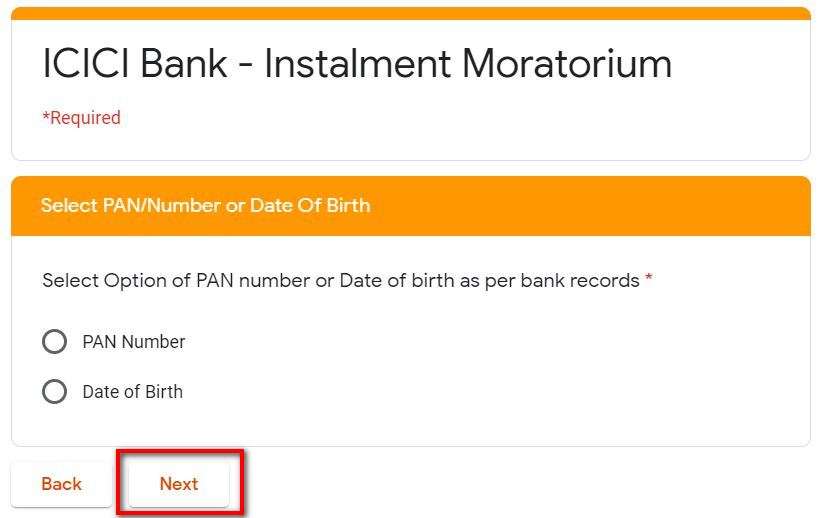

Submit the form and enable moratorium on your ICICI. To apply for the moratorium facility from ICICI Bank follow the steps below Go to ICICI Banks website. A moratorium period is in a loan period in which the borrower does not need to make repayments.

The step-by-step procedure for easily opting for the moratorium can be found on the banks website. While in the case of normal loans. Now fill the ICICI bank loan moratorium application form.

Visit the ICICI Bank homepage. On clicking the said option you will be redirected to a new page. One needs to specifically select every facility for which the moratorium is required.

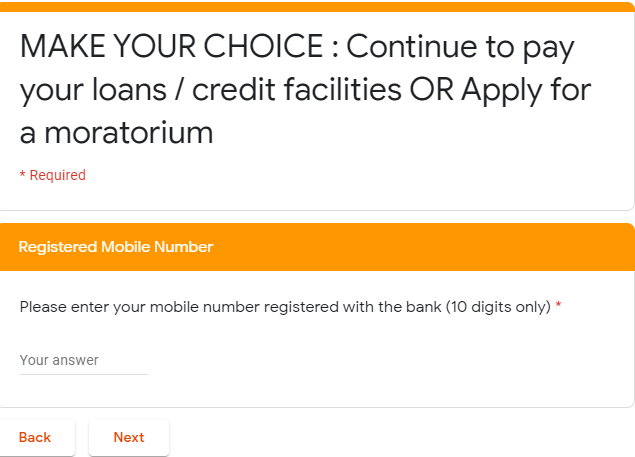

Enter your Mobile number registered with ICICI bank loan account. Process FAQs Charges etc. Alternatively you can access the page directly from the site.

The measures may include change of payment period change in EMI terms etc. If borrowers wanted to postpone the EMI payment for a loan from ICICI Bank then they had to visit the banks website and follow the steps stated for a moratorium. Enter your PAN as per banks records.

When you click on the link you will be taken to the moratorium page on ICICI Banks website. So far only HDFC Bank State Bank of India and ICICI Bank are among the major Indian banks to set out their terms for same. Think of it as a bonus time or grace period.

HDFC Bank will likely ask customers to seek a moratorium by filling in their loan details on the website or sending an email. You will be directed to the following page. Now in the announcement window click.

It is actually the waiting period before the period of repayment starts. On March 27 2020 the Indian Central Bank RBI had said that all the Indian lendersMNC lenders operating in Indian including Bank Non-Banking Finance Companies Housing finance companies and will have to give its borrowers a three-month moratorium on all the. The scheme allows you to postpone paying your dues without impacting your credit score.

Agreeable banks usually offer up to three years of moratorium. One can also send us an SMS through from the registered mobile number mentioning EXITMORAT to 5676766 or 9215676766 for cancellation. For your Credit Card account statement date payment date contracted interest rate transaction dates and due amount kindly check your Credit Card statement.

The eligibility criteria for the ICICI Bank Personal EMI Moratorium can be listed as follows. In respect of all other types of facilities borrowerscustomers will need to specifically OPT-IN for availing of Moratorium and postponement of payments falling due for payment between the period beginning Mar 01 until May 31 2020. In the case of a ready-to-move-in property banks typically give a moratorium of three to six months.

Use the EMI Moratorium Calculator to find out the impact of opting for the moratorium. Some customers will automatically be allowed a moratorium but can opt out if they want to while others will have to specifically ask for the deferment. Click on Choose Your Option link as shown in the above image.

Enter your Date of Birth as per banks records. ICICI Bank will offer customers options based on the product. Yes the moratorium is available for multiple facilities taken from the Bank.

The bank will also consider other cases wherein there have been overdues on EMI payments prior to 1 March 2020. Kindly note the interest provided can vary and will be dependent on the transaction dates payment dates and contracted interest rates. Carefully read the terms and conditions and click Next.

Opting for the moratorium is easy but the specifics vary across banks. All the ICICI Bank Personal Loan customers who have availed a loan before 1 March 2020 are eligible for the EMI moratorium. To request the moratorium online on the website of ICICI bank follow these steps mentioned below.

Choose type of ICICI loan and click Next. Add your registered mobile number with the bank and follow the subsequent instructions to opt for the moratorium. ICICI Bank has divided loans into two categories wherein some customers get enrolled in the moratorium automatically while others have to opt for it manually.

Restructuring is an act in which banks and financial institutions grant concessions to borrowers in times of economic difficulty. How to Apply For ICICI Loan Moratorium. One can visit your nearest loan servicing branch or call the banks customer care number.

However during this period banks will continue charging interest on the outstanding. You will be directed to the following page. Visit the homepage of ICICI bank and click on Choose Your Option.

Icici Bank Moratorium How To Apply Icici Bank Moratorium How To Avail Icici Loan Emi Moratorium Youtube

Defer Icici Bank Emi Loan Emi Moratorium Online Emi Deferment Covid19 Youtube

Icici Bank Moratorium Apply Credit Card Loan Emi Moratorium Extention And Status

Icici Bank Moratorium How To Apply June To August Emi Moratorium At Icici Bank In Bengali Youtube

How To Avail Three Month Moratorium For Icici Bank Emi And Credit Cards Business Insider India

How To Avail Three Month Moratorium For Icici Bank Emi And Credit Cards Business Insider India

Icici Bank Personal Loan Covid 19 Moratorium Emi Period How To Apply Status

![]()

How Can I Get Moratorium In Icici Bank

Icici Bank Personal Loan Covid 19 Moratorium Emi Period How To Apply Status

Daily Tax Icici Bank Announced Moratorium Scheme Facebook

Posting Komentar untuk "How To Update Moratorium In Icici Bank"